-

(0)By : Robert Shiller

Irrational Exuberance 3rd Edition

Irrational Exuberance peers into the fevered mind of the market, where logic falters and illusions drive fortunes skyward—until they collapse. With calm precision and mounting urgency, it dissects the psychology behind bubbles, revealing how stories, sentiments, and collective delusions inflate prices far beyond reason. This is not just an analysis of numbers, but a meditation on hope, fear, and the frailty of human judgment in the face of uncertainty. Can a society built on speculation ever truly see itself clearly—or will it always chase shadows mistaken for light? Beneath the charts lies a warning: what we believe can be as dangerous as what we ignore.

- Originally published: 2000

- Publisher: Princeton University Press, 2016

- Genre: Non-fiction

- Pages: 392

- Book Type: Hardcopy

- ISBN: 9780691173122

- Access: Members!

-

(0)By : Robert T. Kiyosaki

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Rich Dad Poor Dad is a parable of two fathers, two mindsets, and the quiet war between security and freedom. One teaches obedience and the promise of a paycheck; the other speaks of assets, risk, and the daring logic of wealth. Through the eyes of a young boy caught between these worlds, the book asks: what if everything you learned about money was designed to keep you dependent? With crisp clarity and provocative insight, it challenges the reader to question not only how they earn—but why they settle. This is not merely a lesson in finance, but a call to awaken the investor within.

- Originally Published: 1997

- Publisher: Plata Publishing, 2017

- Genre: Personal Finance

- Pages: 336

- Book Type: Hardcopy

- ISBN: 978-1612680019

- Access: Members

-

(0)By : George Soros

The Alchemy of Finance

What if the markets are not machines of logic, but mirrors of our deepest fears, hopes, and illusions? The Alchemy of Finance peels back the polished surface of economic theory to reveal a volatile world shaped as much by perception as by reality. Through the lens of reflexivity—a daring theory that turns traditional finance on its head—the book explores how human bias fuels booms and busts, and how understanding that chaos can become a source of extraordinary insight. Is it possible to profit from uncertainty not by mastering it, but by dancing with it? Both philosophical and razor-sharp, this is a provocative invitation to rethink what we believe about money, markets, and the minds that move them.

- Originally Published: 1987

- Publisher : Wiley, 2015

- Pages: 416

- Genre: Finance, Investing, Markets

- Book Type: Hardcopy

- ISBN-13: 978-0-471-44549-4

- Access: Prime Membership

-

(0)By : Morgan Housel

The Psychology of Money: Timeless lessons on wealth, greed, and happiness

Wealth is not built in spreadsheets but in minds shaped by fear, hope, greed, and patience. The Psychology of Money dives beneath the numbers to reveal the messy, human heart of financial decision-making—where stories, not statistics, rule the day. With elegant clarity and arresting insight, it asks: why do smart people make irrational choices about money, and how can we learn to master behavior rather than markets? This is not a manual of riches, but a meditation on how money dances with time, emotion, and the deeply personal stories we tell ourselves. What if the key to financial success isn’t knowing more, but doing less—and thinking differently?

- Originally Published: 2020

- Publisher: Harriman House, 2020

- Genre: Self-help

- Pages: 256

- Book Type: Hardcopy

- ISBN: 978-0857197689

- Access: Members

-

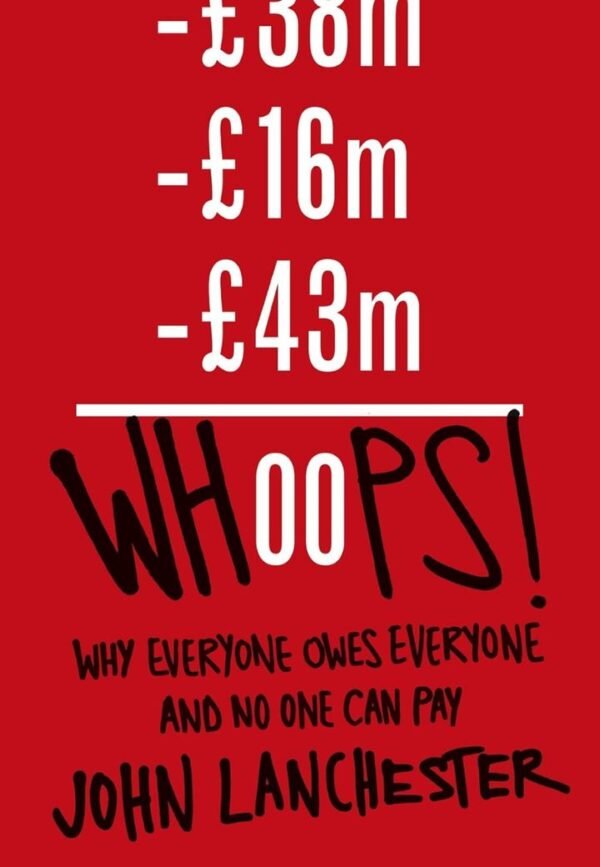

(0)By : John Lanchester

Whoops!: Why Everyone Owes Everyone and No One Can Pay

Whoops! is a witty, unsettling exposé of the modern financial system—how it broke, why no one seemed to notice, and what it says about the stories we tell ourselves about money. With the clarity of a seasoned guide and the humor of someone who’s seen the absurdity up close, it unpacks how brilliant minds and reckless systems collided to trigger a global collapse. At its core is a chilling question: how can something so abstract—numbers, models, jargon—wield such devastating real-world power? This is not just a tale of economic failure, but of human folly dressed in suits and spreadsheets. Can we fix a system built on illusions without first confronting our own?

- Originally Published: 2010

- Publisher: Allen Lane, 2010

- Genre: Non-fiction

- Pages: 240

- Book Type: Hardcopy

- ISBN: 978-1846143229

- Access: Members